Investing in the Future: Opportunities in EV, Power, and Defence Stocks, Semiconductor, Monopoly stocks in India

Welcome to our guide on investing in the future of India. The stock market is full of exciting opportunities, especially in sectors that are growing fast. In this blog, we’ll look at three key areas: electric vehicles (EVs), renewable power, Semiconductor and defence.

India is moving towards cleaner and smarter technologies. The government’s push for reducing pollution and improving technology has opened up new investment possibilities. Electric vehicles are becoming more popular, renewable energy is on the rise, and the defence sector is getting stronger.

These changes are not just good for the country but also for investors. Join us as we explore how you can benefit from investing in these future-oriented businesses in India. Let talk about some stocks which is listed in India stock market NSE and BSE. In this blog we will talk about the Best Stocks for Long Term Investment in 2025

1. Exicom Tele-Systems Ltd

Founded in 1994, Exicom Tele-Systems Ltd is a leading player in power systems and electric vehicle (EV) charging solutions in India. With a robust presence in the critical power business, Exicom provides comprehensive energy management at telecommunications sites and enterprise environments through its DC power systems and Li-ion-based energy storage solutions. The company holds a significant 16% market share in India’s DC power systems market and has deployed over 470,810 Li-ion batteries, equivalent to 2.10 GWH of storage capacity.

Exicom is a pioneer in the EV charger manufacturing segment in India, offering both slow (AC) and fast (DC) charging solutions. With a market share of 60% in residential charging and 25% in public charging, the company has installed over 61,000 EV chargers across 400 locations nationwide.

The company has diversified its revenue streams, with significant contributions from critical power products, services, and EV chargers. Exicom’s three manufacturing facilities and two R&D centers in India underpin its capacity to innovate and scale production. Additionally, the company is expanding with a new facility in Telangana to boost its production capabilities further.

With a growing clientele that includes major automotive OEMs and national CPOs, and an international presence in markets like Thailand, Malaysia, the UK, and New Zealand, Exicom is well-positioned for future growth. The upcoming IPO aims to raise funds for setting up new manufacturing facilities, repaying borrowings, and enhancing R&D efforts, making it a compelling investment opportunity for those looking to tap into India’s evolving power and EV sectors.

2. CG Power and Industrial Solutions Ltd

CG Power and Industrial Solutions Ltd is a global leader providing comprehensive solutions for efficient and sustainable electrical energy management. The company operates through two main segments: Power Systems and Industrial Systems, serving utilities, industries, and consumers worldwide.

With a rich history spanning over 85 years, CG Power has undergone significant transformations. In FY2020, the Murugappa Group’s Tube Investments infused INR 700 Cr into the company, enhancing its growth and stability. Today, CG Power is a market leader in motors and drives, transformers, and switchgears.

In FY23, the company’s revenue mix was 71% from Industrial Systems and 29% from Power Systems, with 90% of its revenue generated domestically. CG Power has 17 manufacturing facilities across India, located in Goa, Madhya Pradesh, and Maharashtra, and plans to expand its capacity further with a capex of approximately 400 Cr over FY24-25.

The company has a strong international presence in countries like Burkina Faso, Kenya, UAE, and the Philippines, aiming to increase its export contribution from 5% to 20% over the next 4-5 years. In FY23, CG Power undertook capital reorganization, redeemed significant non-convertible debentures, and completed the liquidation of its Middle East subsidiary.

CG Power is also making strides in the semiconductor industry. Partnering with Renesas Electronics Corporation and Stars Microelectronics, the company is setting up a semiconductor unit in Sanand, Gujarat, with an investment of Rs. 7,600 crore. This facility will manufacture specialized chips for consumer, industrial, automotive, and power applications.

With its robust infrastructure, strategic expansions, and innovative ventures, CG Power and Industrial Solutions Ltd is poised for sustained growth and leadership in the electrical energy management sector.

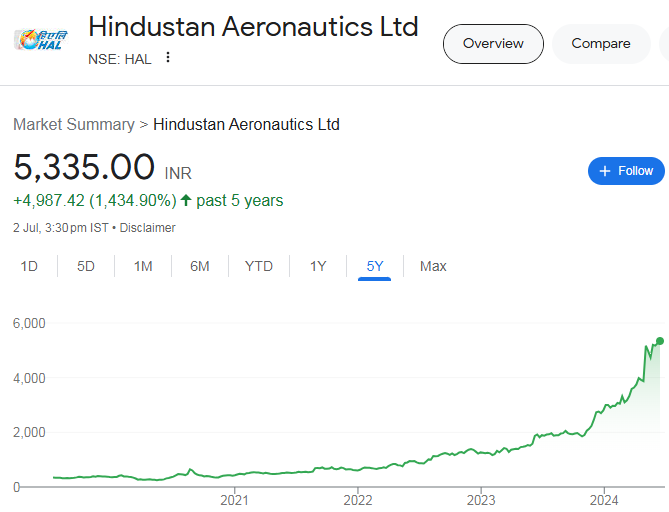

3. Hindustan Aeronautics Ltd

Hindustan Aeronautics Ltd (HAL) is a cornerstone of India’s aerospace industry, specializing in the manufacture and maintenance of aircraft and helicopters. As the sole Indian company with expertise in aircraft manufacturing, HAL plays a strategic role in India’s defense sector, heavily relying on contracts from the Ministry of Defence (MoD). Although its export revenues are minimal, HAL’s significant investments in research and development—about 6% to 7% of its total revenue annually—underscore its commitment to innovation. The company recently increased its R&D reserve to 15% of its profit after tax (PAT) to enhance its technological capabilities further.

HAL’s impressive order book, valued at Rs 94,000 crore as of FY24, is expected to grow with major upcoming orders. The company has forged significant partnerships, including a joint venture with Safran for helicopter engines and an MoU with Israel Aerospace Industries to convert civil passenger aircraft into multi-mission tanker aircraft. HAL also collaborates with Zero Avia on hydrogen-electric powertrains and supplies components to GE Aviation’s LEAP engine program. Financially robust, HAL fully repaid its external debt and held a healthy cash balance of Rs 14,000 crore as of August 2022. These strategic developments and financial strengths position HAL for continued leadership in India’s aerospace sector.

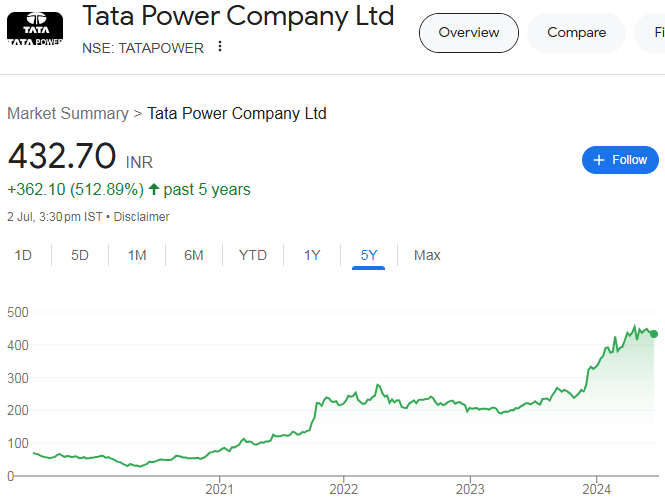

4. Tata Power Company Ltd

Tata Power Company Ltd is a powerhouse in the Indian energy sector, focusing on generating, transmitting, and distributing electricity. The company is committed to producing electricity from renewable sources, with a vision to build 100,000 electric vehicle (EV) charging stations by 2025. As India’s largest vertically-integrated power company, Tata Power boasts a substantial energy capacity of 14,381 MW, including thermal, wind, hydro, waste heat recovery, and solar power. Notably, the company has over 4,900 public EV charging points across 442 cities and towns, with significant ongoing projects to expand its renewable capacity further.

Tata Power’s diverse operations span the entire value chain of the energy sector. The company generates power from both thermal and renewable sources, transmits and distributes electricity, and provides various ancillary services such as EPC, O&M, and project management. Its extensive infrastructure includes 17 manufacturing facilities and a robust global presence, with hydro projects in Georgia, Zambia, and Bhutan, and coal mines in Indonesia. Tata Power aims to achieve over 20 GW of green energy by 2030, accounting for 70% of its total capacity. This ambitious target aligns with its broader goal of reaching 500 GW by 2030, reinforcing its leadership in sustainable energy solutions.

5. HCL Technologies Ltd

HCL Technologies Ltd (HCL Tech) is a premier global IT services company, ranked among the top five Indian IT services companies by revenue. Since its IPO in 1999, HCL Tech has focused on transformational outsourcing, offering a comprehensive portfolio of services including software-led IT solutions, remote infrastructure management, engineering and R&D services, and BPO. Leveraging its extensive global offshore infrastructure and a network of offices in 46 countries, HCL Tech provides multi-service delivery across key industry verticals. The company’s strategic alliances with top global technology firms such as Microsoft, Cisco, and SAP, alongside specialist partnerships, underscore its robust ecosystem and commitment to innovation.

In FY22, HCL Tech’s revenue was primarily driven by IT and Business Services (72%), followed by Engineering and R&D services (16%) and Products & Platforms (12%). Geographically, the Americas contributed 56% of the revenue, followed by Europe (27%), India (4%), and the rest of the world (13%). The company saw significant growth in its client base, with the number of $100 million clients rising to 16. HCL Tech signed over 50 deals with a total contract value of $8.3 billion, encompassing major clients across Europe and the US. The company continued its expansion through strategic acquisitions, including a 51% stake in Gbs-Gesellschaft für Banksysteme GmbH and a 100% stake in Starschema Kft. HCL Tech also incorporated new subsidiaries in Costa Rica, Bahrain, Slovakia, and Morocco, further enhancing its global footprint and capacity to deliver cutting-edge IT solutions.

6. Polycab India Ltd

Polycab India Ltd is a leading manufacturer of cables, wires, and allied products, renowned for its wide range of consumer electrical products including fans, switches, switchgear, LED lights, luminaires, solar inverters, and pumps. With a dominant market share of 22-24% in the domestic organized wires and cables segment, Polycab caters to diverse industries and applications. The company operates 25 manufacturing sites across India, with major facilities in Halol, Daman, Roorkee, Nashik, and Chennai. In FY23, the company invested significantly in capital expenditure and advertising, while also undergoing a brand refresh to “Ideas Connected.” Polycab’s extensive distribution network includes over 4,300 distributors, 205,000+ retail outlets, and numerous regional offices and experience centers.

Polycab is committed to achieving a revenue target of Rs. 20,000 crore by FY26 through its strategic initiative, Project Leap. The company’s business segments include Wires and Cables, Fast Moving Electrical Goods (FMEG), and EPC, with W&C contributing 89% to the product mix. Polycab’s geographical revenue mix is predominantly domestic (90%), with a growing international presence in over 76 countries. The company has a strong foothold in North America and Europe, which together account for a significant portion of its exports. Polycab’s continuous investment in expanding its global footprint and innovative product offerings positions it as a key player in the electrical solutions market.

7. JK Paper Ltd

JK Paper Ltd, established in 1962, stands as a leading player in the paper industry, specializing in office papers, coated papers, and packaging boards. With a diversified product portfolio that includes brands like JK Copier and JK Excel Bond, JK Paper commands a significant market share, particularly holding a dominant 30% share in the branded copier segment. The company’s strategic acquisition of Sirpur Paper Mills Ltd in FY19 further bolstered its manufacturing capabilities, adding a substantial production facility in Kagaznagar, Telangana, with an annual capacity of 1,36,000 metric tonnes.

Operating from integrated facilities in Odisha, Gujarat, and Telangana, JK Paper has ramped up its total production capacity to 7,61,000 metric tonnes per annum. This expansion has not only enhanced its ability to cater to a pan-Indian customer base but also facilitated robust growth in global markets across 60 countries, including prominent regions in the USA, Europe, Middle East, Asia, and Africa. JK Paper’s commitment to quality and operational efficiency is underscored by its achievement of utilization levels up to 103% of installed capacity in FY23, reflecting its effective management and market responsiveness.

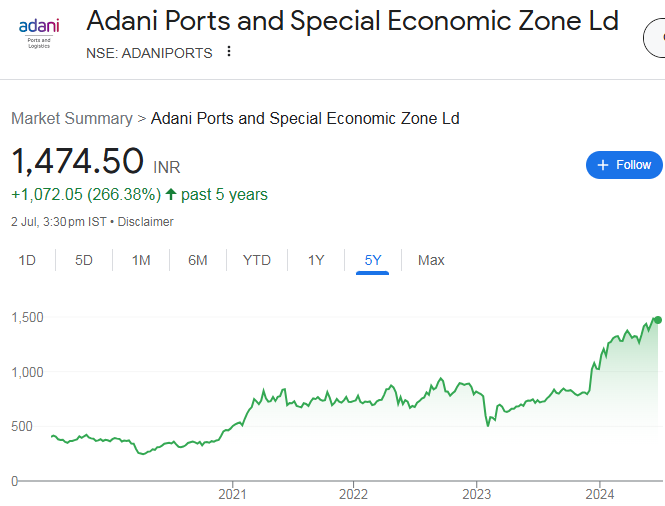

8. Adani Ports & Special Economic Zone Ltd

Adani Ports & Special Economic Zone Ltd (APSEZ) is India’s largest port developer and operator, leading the industry with a comprehensive network of 13 domestic and 2 international ports, including the largest container handling facility in India. The company’s operations extend beyond ports to encompass logistics, SEZs, and maintenance services, driving its status as a market leader in India’s port industry. With strategic acquisitions such as Dighi Port and Krishnapatnam Port, APSEZ has significantly expanded its footprint, enhancing its operational capacity and geographic reach.

APSEZ’s growth strategy includes ambitious plans to become the world’s largest private port company and India’s foremost integrated transport utility by 2030. This vision entails expanding into diverse segments such as rail, logistics parks, warehouses, cold storage, and inland waterways, aiming for a seamless integration of port operations with hinterland logistics across India. Moreover, the company operates the Mundra SEZ, the largest multi-product SEZ in India, facilitating industrial development and trade within its expansive 8,000-hectare premises.

Furthermore, APSEZ is actively reducing its financial exposure by divesting non-core assets and optimizing its loans and advances to group companies. This strategic approach aims to streamline operations and strengthen financial resilience amid its rapid expansion and diversification efforts across various transport and logistics segments.

Incorporating these strategies, APSEZ continues to set benchmarks in the port and logistics sector, leveraging its robust infrastructure and strategic partnerships to drive sustainable growth and leadership in the global maritime and logistics industry.

9. Jio Financial Services Ltd

Jio Financial Services Ltd (JFSL) operates as a crucial entity within the Reliance Group, focusing on financial services through its various subsidiaries and joint ventures. Established as a Non-Banking Financial Company (NBFC-ND-SI) registered with RBI, JFSL oversees a portfolio of consumer-centric financial offerings.

Jio : Group Structure and Subsidiaries:

Jio Financial Services Ltd serves as the holding company for several subsidiaries and joint ventures. Notably, it includes Jio Finance Limited (JFL), which facilitates personal loans for both salaried and self-employed individuals through the MyJio app in Mumbai. The company has also expanded its consumer durable loan offerings across 300 stores nationwide. In addition to JFL, JFSL oversees Jio Insurance Broking Limited (JIBL), which has partnered with 24 insurance companies to offer a wide spectrum of insurance products including life, general, health, and corporate solutions. Further enhancing its financial ecosystem, JFSL manages Jio Payments Bank Limited (JPBL), which recently relaunched savings accounts and plans to introduce debit cards, leveraging a network of approximately 2,400 business correspondents for widespread coverage. Additionally, Jio Payment Solutions Limited (JPSL) has successfully piloted its Sound Box, aimed at enhancing payment solutions for consumers.

Future Products and Initiatives:

Looking ahead, JFSL aims to broaden its financial product offerings. It plans to introduce business and merchant loans tailored for self-employed individuals, sole proprietors, and small businesses. Moreover, initiatives are underway to launch auto loans, home loans, and loans against shares, thereby diversifying its lending portfolio and catering to a broader customer base.

Strategic Ventures:

Beyond its current operations, JFSL is set to venture into the asset management business through a joint venture with Blackrock, indicating its strategic intent to expand its footprint in the financial services sector.

In summary, Jio Financial Services Ltd plays a pivotal role within the Reliance Group’s financial services strategy, aiming to enhance financial inclusion and provide a comprehensive suite of products ranging from loans to insurance and banking solutions, supported by innovative technologies and strategic partnerships.

10. Dixon Technologies (India) Ltd

Dixon Technologies (India) Ltd, founded in 1993, is a leading Electronic Manufacturing Services (EMS) provider renowned for its extensive portfolio encompassing consumer electronics, lighting, home appliances, CCTV cameras, and mobile phones. Operating under both OEM and ODM models, Dixon excels in delivering customized electronic solutions through its robust R&D centers in India and China. With 22 state-of-the-art manufacturing facilities across strategic locations like Noida, Dehradun, and Chittoor, Dixon maintains a dominant position in India’s electronics manufacturing landscape. Its recent expansions include a new manufacturing unit in Dehradun for washing machines and partnerships with global giants like Samsung for technology integration, underscoring its commitment to innovation and market leadership.

Strategically positioned in high-growth sectors, Dixon Technologies (India) Ltd continues to drive innovation and expand its production capabilities to meet increasing market demands. The company’s proactive approach to partnerships and acquisitions, such as the recent acquisition of Ismartu India Pvt. Ltd, enhances its market reach and reinforces its status as a preferred partner for global and domestic brands seeking reliable electronic manufacturing solutions. As Dixon pursues its growth trajectory with substantial investments in infrastructure and technology under government initiatives like the PLI scheme, it remains poised to consolidate its position as a frontrunner in the EMS sector, catering to diverse consumer needs across India and beyond.

11. Zen Technologies Limited

Zen Technologies Ltd., established in 1996 and headquartered in Hyderabad, specializes in designing, developing, and manufacturing cutting-edge combat training and counter-drone solutions for defense and security forces. With a strong focus on indigenization, Zen Technologies serves the Indian armed forces, state police, and paramilitary units, offering advanced technologies that enhance national security.

The company holds a dominant position in the defense training sector, boasting over 95% market share in tank simulators and a robust order book valued at approximately ₹1000 crores as of July 2023. This includes substantial orders for Annual Maintenance Contracts (AMC) and equipment both domestically and internationally. In FY23, Zen Technologies achieved a significant revenue mix with 78% from equipment sales and 22% from AMC services. Their strategic initiatives include expanding their global footprint, enhancing R&D capabilities, and further establishing themselves as leaders in live and virtual land-based simulators and anti-drone technologies.

Zen Technologies continues to innovate in defense technology, backed by a recognized R&D facility and a portfolio of patents. Their commitment to technological advancement and customer satisfaction underscores their leadership in delivering critical solutions to defense and security sectors worldwide.

Conclusion and Disclaimer

To sum up, the companies discussed here, such as Exicom Tele-Systems and Dixon Technologies, showcase strong growth in their respective fields. Adani Ports leads in port infrastructure, while Dixon Technologies excels in electronic manufacturing. These companies highlight diverse business models and solid market positions.

However, please note that the information provided is purely for educational purposes. We do not provide recommendations for buying or selling stocks. Investing in stocks carries risks, and decisions should be based on thorough personal research, financial goals, and advice from a qualified financial advisor. Every investor should carefully assess their own financial situation and risk tolerance before making any investment decisions.